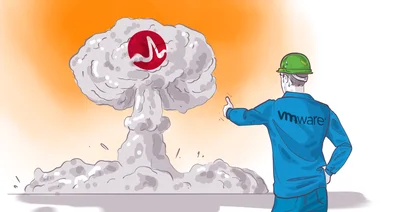

Broadcom killed VMware: Was this acquisition good or bad for you?

I imagine that all of you have used VMware at some point in your life. This is a component that many have utilized, and something significant has happened with VMware this spring.

The problem is that VMware was purchased by Broadcom. This might seem normal, as it's an IT company acquiring another IT company, but there are many complexities involved.

Firstly, VMware had approximately 28,000 partners—companies that acted as resellers. Imagine you are a consulting firm with a client using VMware; you could resell the VMware licenses to them. Now, Broadcom is changing this, planning to reduce the number of partners from 20,000 to 1,000, which is problematic for the other 27,000 partners.

Additionally, they want to shift the company's focus from virtualization to specializing in private clouds. This means if you need a private cloud, you would use VMware as your infrastructure provider, which is a significant change. With the 160 products currently offered, Broadcom plans to streamline this to just a few.

For example, if you visited the VMware store, it was closed from April 8th to May 30th. Prices for new licenses were not until May 13th, leaving customers in the dark about what will be available or the costs.

A major issue arises for customers with existing perpetual licenses. Broadcom stated that these perpetual licenses were no longer valid, and customers must switch to a subscription model. This is a huge shift, especially as fees for educational licenses, for instance, are doubling, and in some cases, are three to four times more expensive than before.

If your infrastructure and applications were built around VMware, you now face a dilemma. Customers were given only six weeks' notice to switch from what was a perpetual model to something completely different, which is an unfair practice.

Many companies are understandably upset, and the European Commission is likely to investigate Broadcom's actions. It's problematic when a company breaks prior agreements and then demands two or three times more in fees.

It’s also worth noting that companies like Nutanix and Dropbox utilize virtualization just as VMware does, but they might not be facing the same challenges.

Another concern is that while companies like Google and Amazon offer VMware on their platforms, they too are aligning with Broadcom's new licensing model, potentially complicating things further.

This situation was a huge challenge for VMware's customers who have built their budgets around the previously stable perpetual licensing model and now, with just six weeks' notice, were forced to adjust to a new, more costly regime.

This was a pivotal moment for competitors like Microsoft and others, who could capitalize on VMware’s customer dissatisfaction and facilitate their transition to alternative platforms. We will keep you updated on the next steps of this story.

Here's the same article in video form for your convenience: